If you want to boost your savings and create an emergency fund, high-yield savings accounts (HYSAs) are a great choice. Online banks offer these accounts with much higher annual percentage yields (APYs) than traditional savings accounts. They provide not just competitive interest rates but also safety with FDIC and NCUA insurance. This makes HYSAs a top savings strategy for many Americans.

Traditional savings accounts usually have a low APY of 0.01%. HYSAs, on the other hand, can offer rates over 4.00% APY, with some even reaching 5%. This means you could earn over 400 times more interest than with a standard savings account. Although there are some downsides, like limits on withdrawals and delays in transfers, the benefits are clear. These include no monthly fees and easy access to your money.

Looking to save for a dream vacation or build an emergency fund? High-yield savings accounts are perfect for these goals. It’s no surprise they’re becoming a key part of many people’s savings plans.

Key Takeaways

- High-yield savings accounts offer APYs significantly higher than traditional savings accounts.

- Safety is paramount with FDIC and NCUA insurance up to $250,000 per depositor.

- No monthly fees and easy access make HYSAs a valuable savings strategy.

- Some accounts might have withdrawal limits, typically capped at six per month.

- Ideal for short-term financial goals like emergency funds or vacations.

What is a High-Yield Savings Account?

A high-yield savings account gives you a much higher APY than traditional accounts. It’s great for short-term savings and emergency funds. Online banks make these accounts possible, cutting costs and passing the savings to you.

Definition and Basics

A high-yield savings account offers much higher interest rates than usual. With rates around 0.52% for savings accounts, high-yield accounts can give you over 4%, even up to 5% APY. They’re mainly found at online banks, which don’t have the high costs of physical branches.

These accounts are also insured by the FDIC, covering up to $250,000 per account. This means your money is safe, making it a good choice for saving.

How It Differs from Traditional Savings Accounts

High-yield savings accounts stand out from traditional ones in several ways:

- Higher APY: Traditional accounts average about 0.46% return, but high-yield accounts can hit 5%. This means your money grows faster.

- Operational Model: High-yield accounts come from online banks, which have lower costs. This lets them offer better rates to you.

- Withdrawal Limits: Like traditional accounts, you can only make six withdrawals a month. This is a rule but important for your savings plan.

- Safety: These accounts are insured by the FDIC or NCUA, so your money is safe up to $250,000.

In short, high-yield savings accounts give you a better return on your money. They’re ideal for short-term goals and keeping an emergency fund. Switching from a traditional account to a high-yield one at an online bank can really help your savings grow.

Benefits of High-Yield Savings Accounts

High-yield savings accounts are great for those wanting to grow their savings. They offer many benefits that help keep your money safe and easy to get to.

Higher Interest Rates

High-yield savings accounts have better interest rates than regular ones. They can offer rates several times higher. For example, the Synchrony Bank High Yield Savings account has rates much higher than average. This means your savings can grow faster.

Safety and Security of Your Funds

These accounts are also very secure thanks to FDIC protection and NCUA insurance. These programs protect your money up to $250,000 per account. So, if your bank fails, your money is safe. This lets you save without worry.

No Monthly Fees and Easy Access

Many high-yield savings accounts don’t have monthly fees. For example, Synchrony Bank’s accounts don’t charge fees or require a minimum balance. They also support online transfers, making it easy to manage your money. Even though they’re meant for saving, they’re still easy to access when you need to.

| Feature | Traditional Savings Accounts | High-Yield Savings Accounts |

|---|---|---|

| Interest Rate | 0.01% – 0.05% | 1.00% – 5.00%+ |

| FDIC Protection | Yes, up to $250,000 | Yes, up to $250,000 |

| Monthly Fees | $5 – $10 | Usually none |

| Accessibility | Immediate | Easy online transfers |

In conclusion, high-yield savings accounts are a smart choice. They offer better interest rates, security, and no monthly fees. These features make them perfect for anyone wanting to save more safely and easily.

Drawbacks of High-Yield Savings Accounts

High-yield savings accounts come with great interest rates and useful features. But, they also have some downsides. Knowing these can help you decide if this account fits your financial goals.

Withdrawal Limits

A big concern with high-yield savings accounts is the monthly withdrawal limit. Most places let you make only six withdrawals a month. Going over can lead to extra fees. So, it’s key to plan your withdrawals well to avoid these costs. This rule can be a problem if you often need to get to your money.

APY Fluctuations

The APY variability in these accounts can be tricky. They usually have higher interest rates than regular savings accounts. But, these rates can change due to market conditions or the bank’s decisions. This means your interest can go up and down, making it hard to predict your savings growth.

Limited Access and Convenience Issues

Even though online banks offer high-yield savings accounts with better rates, they have some online banking limitations. For example, you might not have the same access to ATMs or debit cards as traditional accounts. Also, while mobile banking apps aim to make managing your account easy, there can be tech issues or service gaps that make things less convenient.

It’s important to think about these downsides when considering a high-yield savings account. By understanding the monthly withdrawal limit, APY variability, and online banking limitations, you can see if this option meets your financial needs and lifestyle.

Is a High-Yield Savings Account Worth It?

Thinking about adding a high-yield savings account to your financial strategy is a big decision. These accounts can really help grow your short-term savings, especially for emergency funds, with their high interest rates. They can offer up to 20 to 25 times more interest than regular savings accounts.

High-yield savings accounts are great for keeping up with inflation rates. With the U.S. Federal Reserve’s recent rate hikes, these accounts might offer better rates. This makes them a smart choice for your immediate financial needs.

These accounts also offer great chances for wealth building with their high Annual Percentage Yields (APYs). For example, Poppy Bank gives a 5.50% APY if you keep at least $1,000 in your account. My Banking Direct offers 5.45% APY with no minimum balance.

| Bank | APY (%) | Opening Deposit | Minimum Balance |

|---|---|---|---|

| Poppy Bank | 5.50 | $1,000 | $1,000 |

| My Banking Direct | 5.45 | None | None |

| Forbright Bank | 5.30 | None | None |

| North American Savings Bank | 5.30 | $10,000 | None |

| BrioDirect | 5.30 | $5,000 | $25 |

But, remember that inflation rates can affect your savings over time. High-yield savings might not keep up with inflation in the long run. This could mean your money’s value goes down.

Also, the interest rates on these accounts can change, which might make planning harder. Some banks might charge you if you make more than six withdrawals in 90 days. This could limit how you use your account.

So, whether a high-yield savings account fits your financial strategy depends on your goals. They’re perfect for emergency funds and short-term savings. But for wealth building over many years, you might want to look into investments like stocks and bonds for better returns.

Top High-Yield Savings Accounts of 2024

Choosing the right online savings account with high rates can be tough. Marcus by Goldman Sachs, Ally Online Savings Account, and Synchrony Bank High Yield Savings lead the way. They offer great rates and excellent customer service.

Marcus by Goldman Sachs

Marcus by Goldman Sachs has a competitive APY. It’s often at the top with its savings rates. There are no monthly fees, making it a great choice for savers. Plus, your deposits are insured up to $250,000 by the FDIC, keeping your money safe.

Ally Online Savings Account

Ally Online Savings Account is known for its top-notch customer service and easy-to-use digital banking. It has competitive APYs and no monthly fees. You can track your savings goals easily. Ally Bank is an FDIC member, which means your money is insured.

Synchrony Bank High Yield Savings

Synchrony Bank High Yield Savings offers great APYs and an ATM card for easy access to your money. Their customer service is highly rated. They refund up to $5 in ATM fees per cycle. Synchrony Bank is also an FDIC member, ensuring your deposits are secure.

Here’s a look at some top high-yield savings accounts for 2024:

| Bank | APY | Minimum Balance to Earn APY | Customer Rating |

|---|---|---|---|

| Marcus by Goldman Sachs | 5.25% | $0 | 4.9 stars |

| Ally Bank | 5.20% | $0 | 4.8 stars |

| Synchrony Bank | 5.15% | $0 | 4.7 stars |

| BrioDirect | 5.30% | $25 | 4.6 stars |

| Ivy Bank | 5.30% | $1 | 4.7 stars |

| TAB Bank | 5.27% | $0 | 4.9 stars |

| UFB Direct | 5.25% | $0 | 5 stars |

| Laurel Road | 5.15% | $0 | 4.8 stars |

| Bask Bank | 5.10% | $0 | 4.6 stars |

| EverBank | 5.05% | $0 | 4.7 stars |

| LendingClub | 5.00% | $0 | 4.5 stars |

| Varo Bank | 5.00% | $0 | 4.3 stars |

| Quontic Bank | 4.50% | $0 | 4.6 stars |

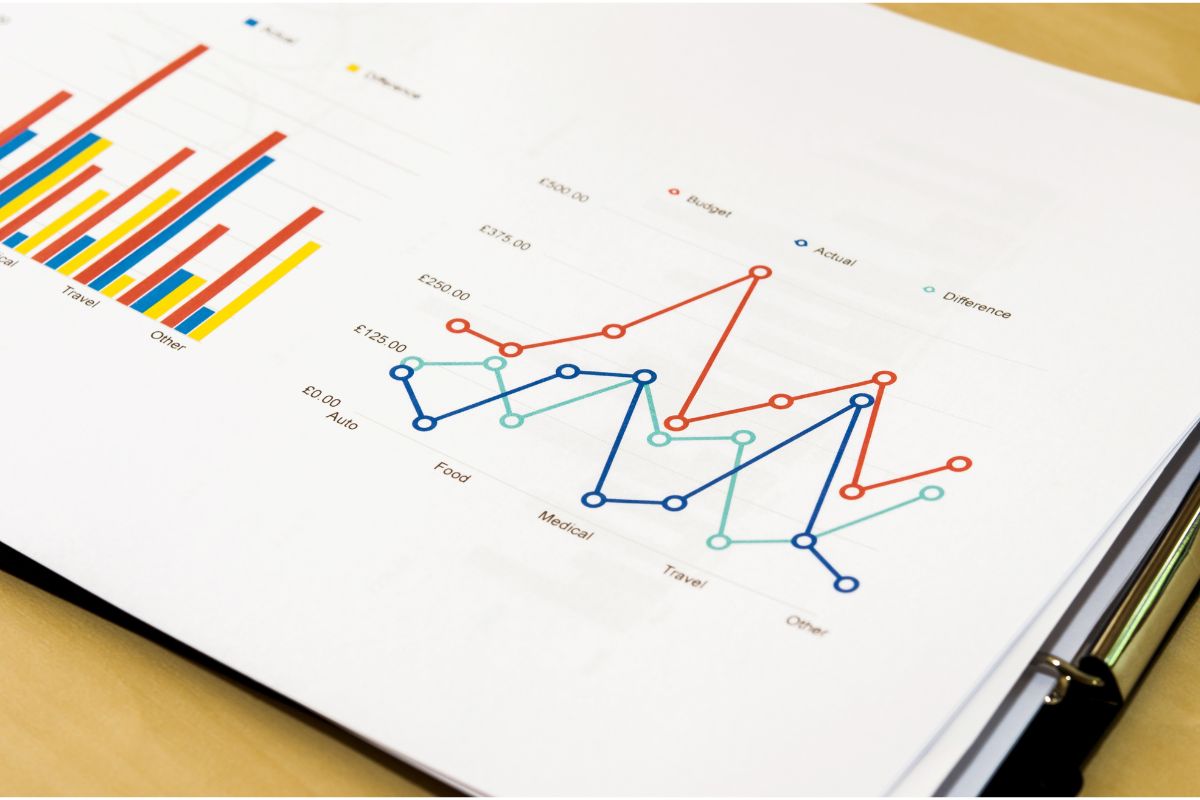

Comparing High-Yield Savings Accounts to Other Savings Options

Looking to grow your money? It’s key to look at high-yield savings accounts and other options like Money Market Accounts (MMAs), Certificates of Deposit (CDs), and regular checking accounts. Each has its own pros and cons, so it’s important to know the differences.

Money Market Accounts

MMAs are a good choice if you want a mix of high interest rates and some flexibility. They let you earn more interest than traditional savings accounts but still offer easy access to your money. For example, you can make up to six transactions a month, just like with high-yield savings accounts.

Some MMAs even offer rates as good as the best savings accounts, plus more flexibility. This makes them a strong option for those who want both security and easy access to their money.

Certificates of Deposit (CDs)

CDs are great for saving for the long term. They require you to keep your money locked in for a set time, from a few months to years. In return, they usually give you a higher APY, which is good if you can afford to keep your money saved.

For example, a 24-month CD might give you a much higher APY than a high-yield savings account. But, you won’t be able to get your money out without a penalty until the term ends.

Regular Checking Accounts

Checking accounts aren’t usually known for earning interest. But, they’re perfect for everyday spending and managing your bills. They offer easy access to your money, which is great for daily use.

However, they usually don’t earn much interest. So, when choosing between checking and savings, think about how often you need to use your money versus earning interest.

By comparing these options, you can find the best mix of earning interest, easy access, and convenience for your financial goals.

Factors to Consider When Choosing a High-Yield Savings Account

Choosing a high-yield savings account (HYSA) means looking at several key factors. These help you get the most from your money. Think about these important points to pick an account that fits your financial goals.

Annual Percentage Yield (APY)

The APY is a key factor. Today, you can find savings accounts with APYs up to 5%. For example, Poppy Bank offers 5.5%, and EagleBank has 5.38%. Checking APYs at different online banks can help you find the best savings returns.

Minimum Deposits and Balance Requirements

Minimum deposits and requirements vary a lot. Some HYSAs need a $1,000 deposit, like CIBC Bank’s Agility HYSA for a 5.01% APY. Others, like TAB Bank, offer 5.27% APY with no minimum deposit.

Fees and Charges

Watch out for fees that can reduce your savings. Ally Bank’s Online Savings Account has a 4.20% APY with no fees. SoFi Checking and Savings offers 4.60% APY with no monthly fees for those with direct deposit.

Convenience and Access

Easy access to your money is key. Online banks often have great digital tools and apps. For example, Synchrony Bank High Yield Savings lets you use an ATM card for unlimited withdrawals, making it easy to get to your cash anytime.

| Bank | APY | Minimum Deposit | Fees | Special Features |

|---|---|---|---|---|

| Poppy Bank | 5.5% | $0 | None | FDIC insured |

| CIBC Bank (Agility HYSA) | 5.01% | $1,000 | None | Easy online access |

| Ally Bank | 4.20% | $0 | No maintenance/overdraft fees | Comprehensive digital suite |

| Synchrony Bank | 4.75% | $0 | None | ATM card availability |

| SoFi Checking and Savings | 4.60% | $0 | None | Member benefits with direct deposits |

Make sure your HYSA is FDIC or NCUA insured for up to $250,000 coverage per depositor. By considering APY, savings calculators, and online banking ease, you can find a high-yield savings account that fits your needs.

How to Open a High-Yield Savings Account

Opening a high-yield savings account is easy and rewarding. You can earn interest rates up to 10 to 12 times the national average. It usually takes just about 10 minutes to apply online.

Steps to Get Started

- Visit the website of your selected bank or credit union.

- Navigate to the high-yield savings account section.

- Click on the option to apply for a new account.

- Fill out the online application form with your personal details.

- Review the terms and conditions before submitting your application.

Requirements and Documentation

To open an online savings account, you need certain documents:

- Personal Identification: A valid ID like a driver’s license, passport, or state ID.

- Contact Information: Your current address, phone number, and email.

- Social Security Number: Needed to verify your identity.

These documents make sure your account meets federal and state banking rules.

Initial Deposits and Transfers

After applying online, you must fund your account. You can do this through:

- Electronic Transfers: Move money from another bank account to your new one.

- Wire Transfers: A way to transfer bigger amounts of money.

Online banks offer higher interest rates because they don’t have the costs of physical branches. Once you fund your account, you start earning interest right away. This way, you enjoy the perks of high-yield savings with little effort.

Here’s a quick summary of the steps:

| Step | Description |

|---|---|

| Start Application | Begin the online application on your chosen bank’s website. |

| Provide Documentation | Submit personal identification, contact details, and your Social Security Number. |

| Fund Account | Make an initial deposit via electronic transfer or wire transfer. |

| Approval and Access | Gain access to your account details and start earning interest. |

Are High-Yield Savings Accounts Safe? Understanding FDIC and NCUA Insurance

High-yield savings accounts are safe thanks to government-backed insurance. In the U.S., banks and credit unions are protected by the FDIC and NCUA. This means your money up to $250,000 is safe if your bank fails.

FDIC vs. NCUA

The FDIC and NCUA protect your money but in different ways. The FDIC covers bank deposits like savings and checking. The NCUA does the same for credit unions. Both offer up to $250,000 protection per person per account type.

FDIC insurance is funded by banks, while NCUA insurance comes from credit unions. This ensures your money is safe.

Insurance Limits and Coverage

FDIC and NCUA insurance offer strong protection for your money. You’re covered up to $250,000 per bank or credit union for various accounts. This includes savings, checking, CDs, and money-market accounts.

Ownership types like joint accounts and retirement accounts also get separate coverage. But, these insurances don’t cover investments like stocks or life insurance.

So, if you have a high-yield savings account at a federally insured bank or credit union, you’re covered. Knowing about these protections can make you feel more secure and help you save better.